Revenue Assurance

the challenge

Revenue assurance is the application of a process, software or analytic solution that enables an organization to accurately capture revenue for all services rendered. Instead of correcting errors after they occur, or not detecting and correcting them at all, revenue assurance enables the relevant department to examine and plug dozens of actual or potential revenue leakage points throughout the organization’s processes and systems, and to correct data before it reaches the billing system.

The key here is to accurately compute the actual expected revenue completely independently of the billing system, by analyzing the sales orders and invoicing data held in various journals & tables on the accounting software databases.

An automated revenue assurance model would be useful in the following scenarios :

- Ensuring correct billing, item pricing and discounting on goods or services rendered for retail providers.

- Ensure accurate computation of the fees, charges and levies accrued for transactions processed by banking and financial institutions.

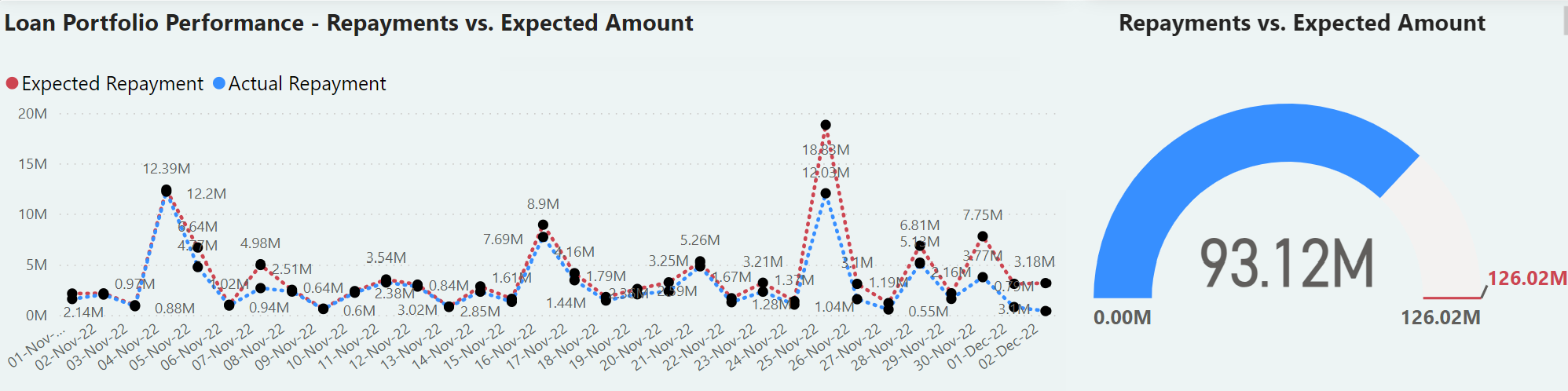

- Flag discrepancies between expected loan repayment amounts and the actual realized loan payments per period or per customer in a lending institution.

- Correctly capture revenue earned per customer on network usage for a communications service provider.

Solution

Using suitable data analytics techniques, we examine invoicing, sale order data, network utilization or transaction journal data from the ERP or accounting systems. Guided by the organization’s business processes, we can create revenue reports per customer or period. For best results, the revenue reports are independently built from scratch – using the raw GL or journal data as opposed to using pre-built system reports.

We then compare the expected revenues to the data held in the billing and payment systems. Any discrepancies in the expected revenue (per client or per period) and the billed or paid amount can be flagged as soon as they occur.

A large part of revenue assurance is also ensuring compliance with income collection polices. This revenue assurance workflow can be designed to flag the following items as well :

- Late billing on rendered services.

- Suspect or non-compliant discounting on sale orders/invoices.

- Un-authorized changes to customer credit limits.

- Non-compliant payment terms or credit terms.

Finally, the workflow or scripts are scheduled to constantly check and verify for the items above on a specified frequency. The idea here is to flag any exceptions before payment is made against suspect billing.

Results

The biggest advantage of implementing an automated revenue assurance model is that it helps in reducing potential risks to revenue growth by identifying any issues that could lead to income leakage or revenue loss. It also has the following benefits :

- Ensures accurate and audit-ready records. An independent computation of the company’s income statement is generated by the workflow.

- Prevents income loss from incorrect invoicing or billing.

- Improves cash flow by ensuring timely billing and collections.

- Enhances compliance with the organizations’ policies on revenue collection and other state regulations such as changes in the tax regiment.